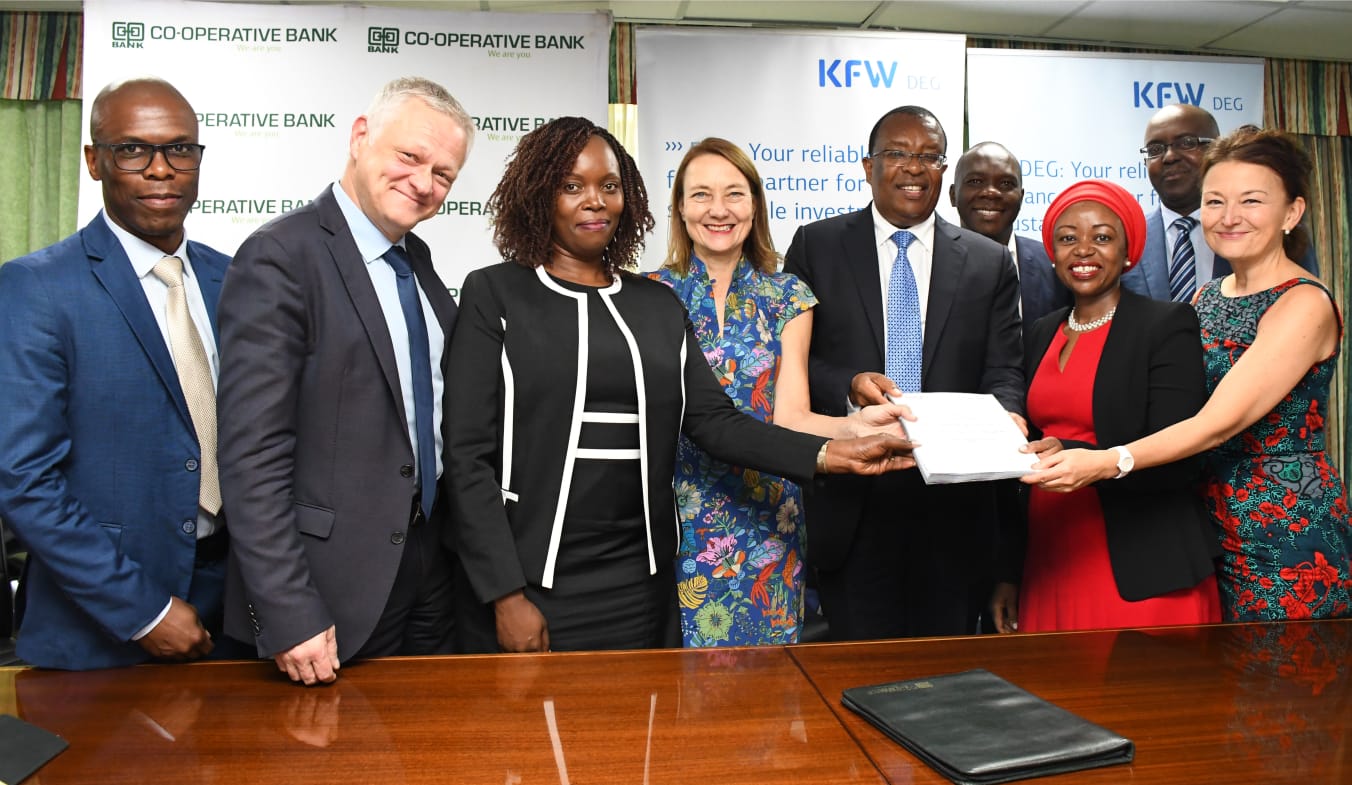

The Co-operative Bank of Kenya has received a long-term 7-year funding facility amounting to USD 100 million (Kshs 13.8 Billion) from a consortium of financial institutions led by DEG for on-lending mainly to Micro, Small and Medium-sized Enterprises (MSMEs) in Kenya.

The loan is a Tier II Facility that has already been fully disbursed, where DEG acted as Lender, Mandated Lead Arranger and Facility Agent while the Consortium included The Africa Agriculture & Trade Investment Fund (AATIF), Micro Small Medium Enterprises Bonds (MSMEB) and European Development Finance Institutions namely Finnfund, Norfund and the co-financing facility European Financing Partners (EFP).

Commenting upon the disbursement of the facility, Co-operative Bank Group Managing Director & CEO Dr. Gideon Muriuki said:

“The funding by DEG and the Consortium is most timely in view of the great need to better support our business customers. In addition, the long-term tenure of the facility has significantly boosted the bank’s ability to offer solutions that are better structured to fulfil the long-term financing needs of MSMEs.”

Monika Beck, Member of DEG’s Management Board said:

“By acting as lead arranger and providing the subordinated loan to Co-op Bank, DEG contributes to the further development of Kenya’s financial sector and the wider economy through the creation of jobs and local income, all geared towards the attainment of Sustainability Development Goals.”

Co-op Bank continues to leverage its strong balance sheet to access funding and allied partnerships with global development partners to enhance the bank’s opportunities for growth and overall performance as here under;

- Enhance the bank’s assets and liability match where long-term loans can be financed using the long-term debt.

- Diversify the bank’s asset and funding portfolio.

- Expand the bank’s client base especially among MSMEs.

- Boost the bank’s competitive position on account of affordable lending.

The DEG-led facility is a significant support to the bank especially at this point in time when the bank’s digitization journey is moving full steam ahead with the recent transition to a new, robust core banking system.