So you have discovered a niche that you can take advantage of online in order for you to make some major bank right? Well, how do you go about running your business safely and avoiding identity theft of either yourself or your clients?

The first step is to understand what identity theft is. Identity theft is what we call the crime of someone using your personal data (name, passwords, birth date) to impersonate then steal from you.

It is a threat experienced by people who choose to conduct business of any nature online.

1. Credit identity theft

Credit identity theft happens when a criminal uses your personal information, such as birthdate and Social Security number, to apply for a new credit line.

Warning signs: You might see an unexpected change in your credit scores or an account you don’t recognize on your credit reports. You may get debt collection notices or a court judgment against you. The best way to prevent it is to freeze your credit.

2. Child identity theft

Criminals steal a child’s identity and apply for credit in that child’s name. Often it is not discovered until the victim applies for college loans or other credit.

Warning signs: If your child is getting offers of credit cards or phone calls about late payments or debt collections, investigate. You can freeze your child’s credit to prevent it.

3. Synthetic identity theft

Synthetic identity theft is when criminals use a patchwork of identity details to construct a fictitious consumer, using a Social Security number — often one of a minor child or one that is simply made up — that is not yet in the credit bureaus’ database and combining it with a name and address. They then apply for loans and credit cards, often making payments for years as the credit limits grow. Then comes a “bust out,” when cards are maxed out and the criminals disappear.

Warning signs: If you try to freeze your child’s credit and discover their Social Security number is already in use. Often it is not discovered until the child is applying for student loans. It is not always preventable, because sometimes criminals make up and use a Social Security number even before it’s assigned.

4. Taxpayer identity theft

Sometimes fraudsters use a Social Security number to file a tax return and steal your tax refund or tax credit.

Warning signs: You may be unable to e-file because someone else has already filed under that Social Security number, you get an IRS notice or letter referencing some activity you knew nothing about or IRS records suggest you worked for an employer that you did not. Filing early can help you beat criminals to filing in your name, and some states offer six-digit identity protection PINs (after a rigorous verification) with additional security.

5. Medical identity theft

Using someone else’s identity to get health care services is medical identity theft. It’s particularly dangerous because it can result in medical histories being mixed, giving doctors and hospitals wrong information as they are making health care decisions.

Warning signs: Claims or payments on your insurance explanation of benefits that you do not recognize can suggest that someone is using your health care benefits. If you’ve fallen victim, you’ll need to both report it to your insurance company and inform your health care team to be sure information in your health care records is actually yours.

6. Account takeover

Criminals use personal data to access your financial accounts, then change passwords or addresses so that you no longer have access.

Warning signs: An email, letter or text from your financial institution that refers to an action (like a password or email change) or transaction you don’t recognize.

7. Criminal identity theft

Criminal identity theft occurs when someone gives law authorities someone else’s name and address during an arrest or investigation. This is often done with false identification, such as a fake driver’s license.

Warning signs: You may be detained by a police officer for reasons that are unclear to you, or be denied employment or a promotion because of something found in a background check.

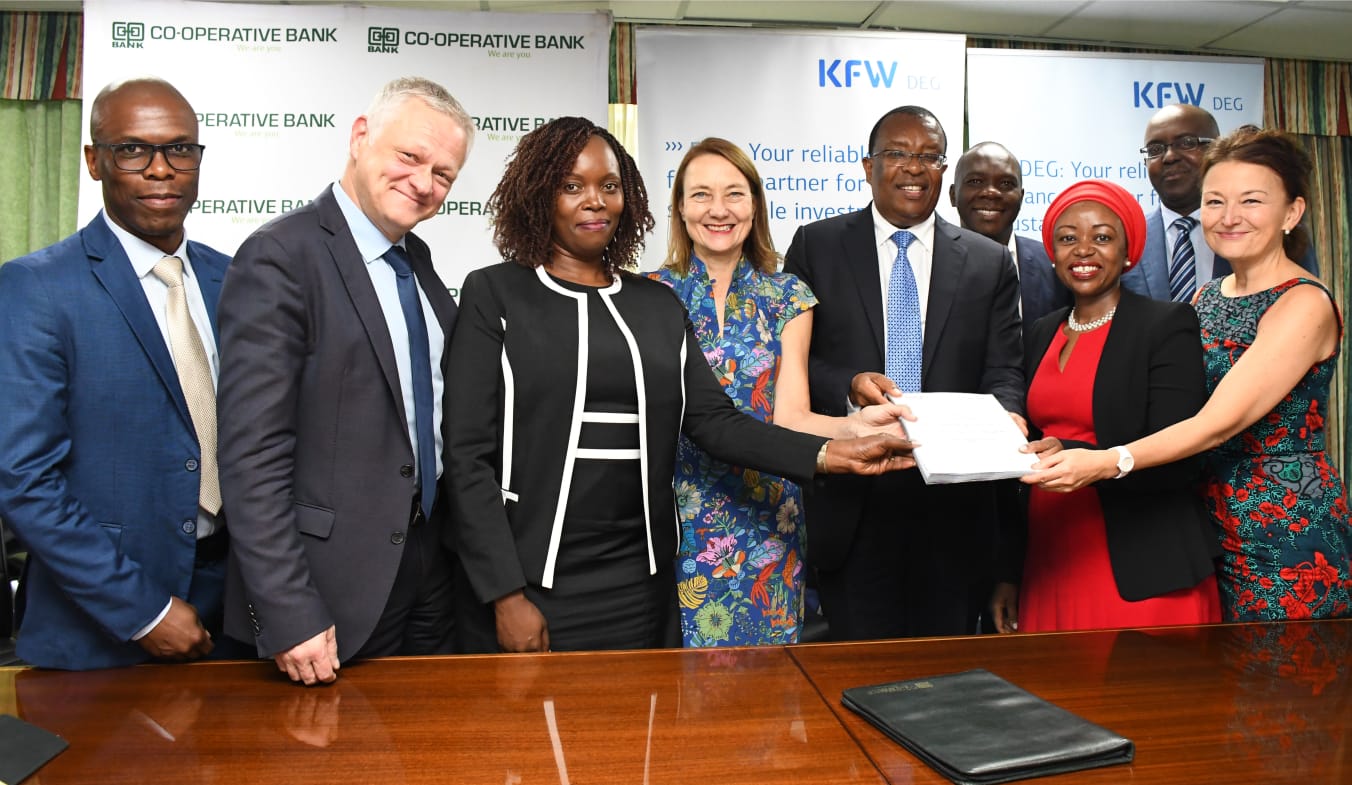

So how can you keep yourself safe from all these risks? Well, that is where Coop Bank comes in. They will partner with you to ensure you do not fall prey to Yahoo Boys or wash-wash clowns. These are the services they offer to ensure you do not get conned:

Online card payments

Boost your sales by integrating into our online card payment solution to receive card payments from customers from different banks and from anywhere in the world.

These are Co-op Bank ATM’s, Debit or Credit Cards. All payments for purchases or goods delivered can easily be checked off by swiping these cards.

With card payments, it’s easier to track stock levels, and enjoy an easy check out flow.

PDQ/POS

This is a device that refers to a payment terminal accessed by Visa cards to make electronic fund transfers. They are common in malls, supermarkets and fuel stations.

POS stands for Point Of Sale in a business outlet. PDQ stands for ‘Process Data Quickly’.

Co-op Bank avails PDQ/POS machines to their clients. These machines greatly boost sales by enabling them receive card payments from customers from different banks.

A trader enjoys timely reports, easier tracking of income and expenses.

Lipa Na M-Pesa Till Number

Co-op Bank provides this service in partnership with Safaricom M-Pesa service. The bank offers to process a till number for their client’s businesses, at no charge.

This helps a business to receive cashless payments via Lipa na M-Pesa Till Number – usualy displayed at payment point at the business premises.

The money clients pay through the Till number is deposited directly into the client’s Co-op Bank account.

The payments paid into the account can be accessed anytime via Co-op Bank’s mobile banking platform, ATMs, Co-op Kwa Jirani agents, Internet banking or at any branch across the republic.

M-Pesa Paybill 400200

Co-op Bank’s official M-Pesa Paybill number – 400200 – enables a trader to receive payments directly into their Co-op Bank account.

The money reflects into the account immediately. One can also check for the payment confirmation via mobile banking or internet banking platforms.

Alternatively, one can receive notifications via text if they have subscribed to the MCo-op Cash SMS notifications.

The funds are accessible anytime via the banks’s mobile banking platform, Co-op Kwa Jirani agents, ATMs, Internet banking or at the branch.

M-Coop Cash

This feature is not limited to business owners, but to everyone with a Co-op bank account. It’s applicable to all needs that require exchange of money.

Encourage colleagues, family members, clients or business associates who have Co-op Bank accounts to send money directly account using the MCo-op Cash App or via USSD *667#.

How does a business boost sales?

- Easier tracking of expenses.

- Timely business reports.

- Easy check out flow.

Instant payment confirmation via SMS notifications or via internet banking platform.

Payments are deposited into Co-op Bank account – easy access anytime via mobile banking platform, ATMs, Co-op Kwa Jirani agents, internet banking and at the branch.

How does a client register for Co-op Bank online banking?

You can log in and transact using any internet-enabled device including mobile phone, tablet, laptop or desktop computer.

Registration is INSTANT and FREE of charge. All you need is your National ID and any of your Co-op Bank ATM cards. Click here to register.

You’ll create your own username and password, which you can re-set anytime in case you forget or feel the need to change.

Every time you log in or do a transaction, you’ll have to enter an OTP (One Time Password) which is sent to your mobile number or email address.

This is a security feature Co-op Bank has in place to keep accounts secure.