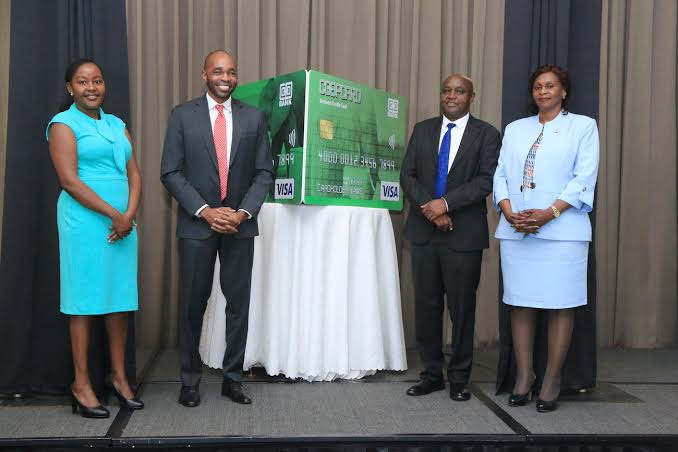

Co-operative Bank of Kenya, in partnership with Visa, have launched a Debit Card, a Credit Card and a Pre-paid Business Card.

This is designed to transform how Medium and Small Business Enterprises, Cooperative Societies and Corporate Institutions in Kenya manage their expenses, empower employees and optimize financial control.

The cards, which can be used both locally and internationally, enable customers to separate business expenses from personal expenses. This means customers can:

– Make payments directly from their business account

– Access interest-free credit to manage cash flow

– Digitize and track office and travel expenses

In all these transactions, customers will be enjoying business-centric discounts from selected Visa merchants globally.

The cards are available to existing Co-op Bank customers and non-customers, and can be obtained from any Co-op Bank branch countrywide.

In delivering his keynote speech at the event, Co-op Bank’s Ag. Director of Retail Banking Mr. Moses Gitau noted:

“This event marks a major milestone in Co-op bank’s digital transformation journey in which the bank has invested heavily including the successful upgrade of its core banking system in 2023 at a cost of over Kes 5Billion, to drive innovation and support businesses in their digitization efforts by bringing together the best in banking and technology…”

Visa East Africa Vice President and General Manager added a few remarks:

“This launch marks a significant milestone in our partnership with Co-op bank and our ongoing efforts to support small and medium-sized enterprises (SMEs) and commercial enterprises in their journey towards digital transformation.

Digital payments are not just convenient; they are a catalyst for business growth and economic development. In today’s fast-paced digital world, businesses need to adapt to stay competitive, and digital payments play a crucial role in this transformation” He added.

Recently, the Bank has received several awards including the highest IT accolade in the banking sector at this year’s CIO100 Awards.

The IT award celebrates innovation, leadership and excellence of organizations that have made a tangible impact on business operations, community development, and digital transformation across the African continent.