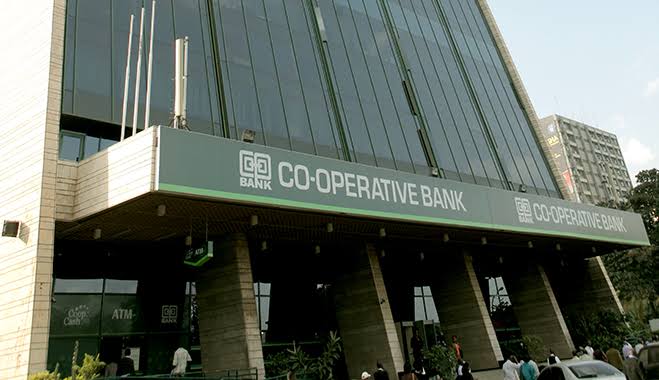

Co-op Bank is pleased to report a Profit Before Tax of Kshs.34.8 Billion for FY2024, a commendable 7.5 per cent growth compared to Kshs.32.4 Billion recorded in FY2023.

This represents a Profit after Tax of Kshs. 25.5 Billion compared to Kshs. 23.2 Billion reported in 2023, a growth of 9.8 per cent.

Thestrong performance by the Bank is in line with the Group’s strategic focus on sustainable growth, resilience, and agility, riding on the ‘Soaring Eagle’ Transformation Agenda.

Dividend

The strong performance has led to a sustained increase in shareholder value as reflected in the competitive Return on Equity of 19.7%.

The Board of Directors has recommended a dividend of Kshs 1.50 per share, subject to approval by the regulators and shareholders.

The Annual General Meeting (virtual) will be held on Friday, 16th May 2025.

Key Performance highlights:

Financial Position: The Group has registered strong growth as follows.

- Total Assets grew to Kshs.743.2 Billion, a 10.7% growth from Kshs 671.1 Billion in the same period last year.

- Net loans and advances remained stable at Kshs.373.7 Billion compared to Kshs.374.2 Billion in 2023.

- Customer deposits grew to Kshs. 506.1 Billion, a 12.1% increase from Kshs. 451.6 Billion.

- External funds from development partners were Kshs. 55.4 Billion compared to Kshs.67.3 Billion in 2023.

- Shareholders’ funds have grown to Kshs. 145.4 Billion, a 28% increase from Kshs. 113.6 Billion in 2023 driven by the strong growth in retained earnings of Kshs. 16.7 Billion.

Comprehensive Income

- Total operating income grew by 12.5% from Kshs. 71.7 Billion to Kshs. 80.6 Billion.

- Total non-interest income grew by 10.1% from Kshs. 26.5 Billion to Kshs. 29.1 Billion.

- Net interest income grew by 13.9% from Kshs 45.2 Billion to Kshs 51.5 Billion.

- Total operating expenses grew by 17.7% from Kshs 39.7 Billion to Kshs. 46.7 Billion.

Cost Management

The Group reports excellent efficiency gains from the various initiatives to record a Cost-to-Income Ratio of 47.2% in FY2024, from 59% in FY2014 when we began our Growth & Efficiency journey.

A Strong Digital Footprint

The Bank continues to leverage its core banking system (Latest version of Finale from Infosys – one of the best rated globally) to support the Group’s digital synergy.

The system continues to enhance service excellence and support innovative and advanced banking solutions.

Through our digital channel strategy, the Bank has successfully moved over 92% of all customer transactions to alternative delivery channels, a 24-hour contact centre, 617 ATMs & Cash Deposit Machines (CDMs), mobile & internet banking and over 16,000 network of Co-op kwa Jirani agents.

Our Omni-channel platform continues to offer users accessibility and enhanced experience.

The platform interfaces online banking through personal computers, mobile phones and USSD availing our services to all customers through their preferred channel yet retain the same user experience from wherever they are.

Mco-op Cash Mobile wallet continues to drive substantial non-funded income streams with Kshs 76.7 Billion in loans disbursed in FY2024, averaging Kshs. 6.39 Billion per month.

Over 235,617 customers have taken up the MSME packages we rolled out in 2018, and 66,100 have been trained on business management skills.

Year to date, we have disbursed Kshs. 14.2 Billion to MSMEs through our Mobile E-Credit solution. MSMEs make up 16.6% of our total Loan Book.

Our unique model of retail banking services avails access to cash for FOSA operations, enabling 619 FOSA outlets to support over 15 million Sacco members access banking services even in rural/remote areas.

Wide and Expanding Branch Network

The Branch network has expanded to a total of 211 outlets (5 in South Sudan).

We have planned 15 additional outlets this year, with 14 already opened at these locations: Imaara Mall-Mombasa Road-Nairobi, Ugunja in Siaya, Luanda, Isibania, Maai Mahiu, Dagoretti Market, Marimanti, Ruiru Nord Mall, Naromoru, Eldoret Airport Road, Eldama Ravine, Westlands Square Executive Centre, Eastleigh BBS Mall and Rumuruti.

Kingdom Bank opened its 23rd branch in Machakos County along Mbolu Malu Road, being the fourth branch opened recently.

Co-operative Bank of South Sudan opened its fifth branch in Wau, supporting business growth and financial inclusion in South Sudan.

A Growing Team

The Bank continues to invest in a competitive team set to serve at existing functions at the same time tap new growth opportunities across all areas of the business.

Staff Numbers have grown from 4,864 as at the close of 2022 to 5,863, creating job opportunities for over 999 young people.

Subsidiaries

Co-op Bancassurance Intermediary Ltd posted a Profit Before Tax of Kshs. 1.2 Billion in FY2024, riding on strong penetration of Bancassurance business.

Co-operative Bank of South Sudan that is a unique joint venture (JV) partnership with Government of South Sudan (Co-op Bank 51% and GOSS 49%) made a Profit Before Tax of Kshs 453.8 Million in FY2024.

This performance was however restated to reflect the changes in general purchasing power of the South Sudanese Pound resulting in a profit of Kshs. 11.1 Million.

Co-op Trust Investment Services Ltd contributed Kshs. 386.4 Million Profit Before Tax in FY2024 compared to Kshs. 226.0 Million in FY2023, a commendable 71% growth.

The Subsidiary has Funds Under Management currently at Kshs. 381 Billion.

Kingdom Bank Limited (A niche MSME Bank) contributed a Profit Before Tax of Kshs. 1.07 Billion in FY2024.

Commitment to Sustainability

In 2022, the Bank embarked on an enhanced Environmental, Social and Governance (ESG) roadmap to integrate ESG considerations into its operations with several key milestones achieved.

Most Sustainable Bank in Kenya

The Bank’s commitment to ESG excellence was celebrated at the 2024 Kenya Bankers’ Sustainable Finance Catalyst Awards, with the Bank emerging as the Overall Award Winner.

This was the Fifth win by the Bank since the inception of the Award seven years ago.

Supporting Industry effort on climate risk management

The Bank is playing an active role in supporting climate change initiatives (IFRS S1 & S2, Green Finance Taxonomy) that are being led by our regulator Central Bank of Kenya and the industry lobby group Kenya Bankers Association.

Co-op Bank has the highest capacity-building rate in Kenya Bankers Association Sustainable Finance Module XII on Climate Risk.

Climate Risk Project

We have, in line with Sustainable Development Goals (SDG) number 13 ‘Take urgent action to combat climate change and its impacts’ embarked on a Climate Risk Project with the aim of formulating an effective Climate Strategy Roadmap and Implementation Plan to chart a clear path towards our climate goals.

Co-op-a-Maji Loan

The Bank, in partnership with Water.org has launched a new Co-op-a-maji loan to support businesses in the Water, Sanitation & Hygiene (WASH) sector.

This is in line with our ESG focus, enabling communities access safe water and sanitation.

The facility targets individuals, water bottlers & distillers, licensed borehole drilling companies, water service providers, manufacturers and distributors of water harvesting equipment.

Co-op Bank Foundation

The Group’s social investment vehicle, continues to provide Scholarships to gifted but needy students from all regions of Kenya.

The sponsorship includes fully paid secondary education, full fees for University education, Internships, and career openings for beneficiaries.

The foundation is fully funded by the bank and has supported 11,639 students since the inception of the program.

Accolades

The Bank was recognized as Bank of the year (Kenya) at the 2024 The Banker, Bank of the year Awards (by Financial Times of London).

Additionally, at the 2024 CIO Africa Awards the Bank was named Winner – Banking Sector.

Conclusion

The Co-operative Bank Group continues to pursue strategic initiatives that focus on resilience and growth in the various economic sectors.

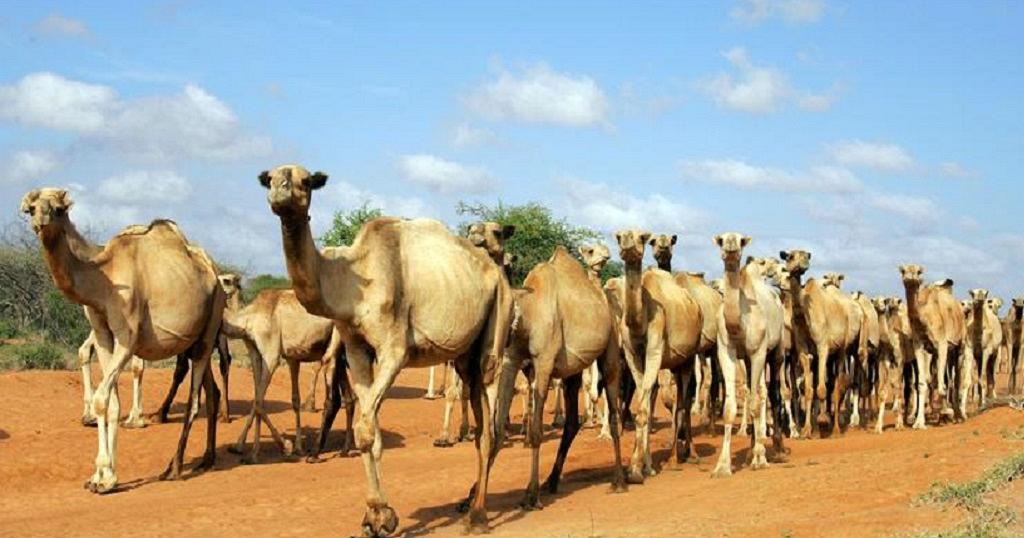

This is anchored on a successful universal banking model supported by an innovative digital presence, a wide physical footprint, and the unique synergies in the over 15-million-member co-operative movement that is the largest in Africa.