Kenya’s matatu industry is in turmoil after Directline Assurance, the leading insurer for public service vehicles (PSVs), announced a sudden closure. However, the Insurance Regulatory Authority (IRA) swiftly refuted the claim, stating the company remains operational.

Family Feud or Financial Woes?

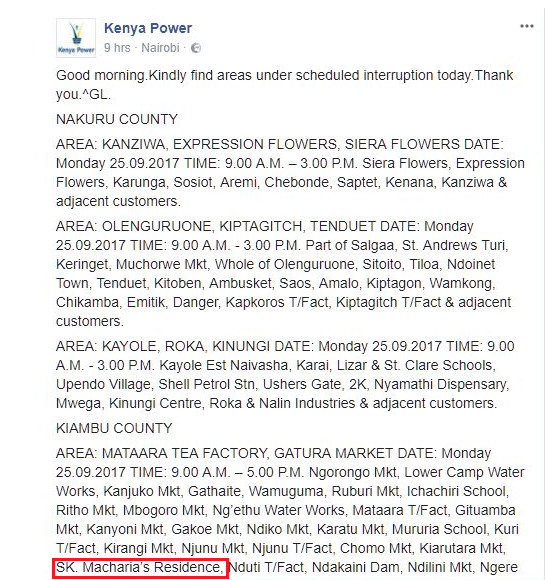

Royal Credit Limited, owner of Directline, blames the closure on a family dispute and alleged mismanagement by former directors. They claim the company lost Sh7 billion and accuse the IRA of inaction.

IRA Denies Closure, Vows to Protect Policyholders

The IRA dismisses the closure as invalid and assures policyholders their coverage remains intact. They’ve placed Directline under close watch and plan to take necessary steps to ensure its stability and protect policyholders’ interests.

Matatu Industry Calls for Intervention

The Matatu Owners Association (MOA) urges government intervention to ensure policyholder safety and industry stability. They express concern about confusion caused by conflicting reports and potential fraud from “fake” claims. The MOA calls on the Law Society of Kenya (LSK) to crack down on such fraudulent activities.

Directline’s Financial Troubles

While the closure drama unfolds, reports suggest Directline faced financial difficulties. Profits drastically dropped in 2023, and liabilities exceeded assets.

Uncertain Future

The future of Directline remains unclear. The family feud complicates matters, and the IRA’s actions will determine the company’s fate. One thing’s certain: the matatu industry awaits a resolution to ensure continued insurance coverage.