The government is set to implement a new tax collection system aimed at addressing tax evasion in Kenya’s informal sector, which has long been a challenge. Starting in December 2024, all transactions made through digital payment methods, such as paybills and tills, will be automatically monitored for taxation. This system is designed to ensure that even small businesses contribute fairly to the tax system.

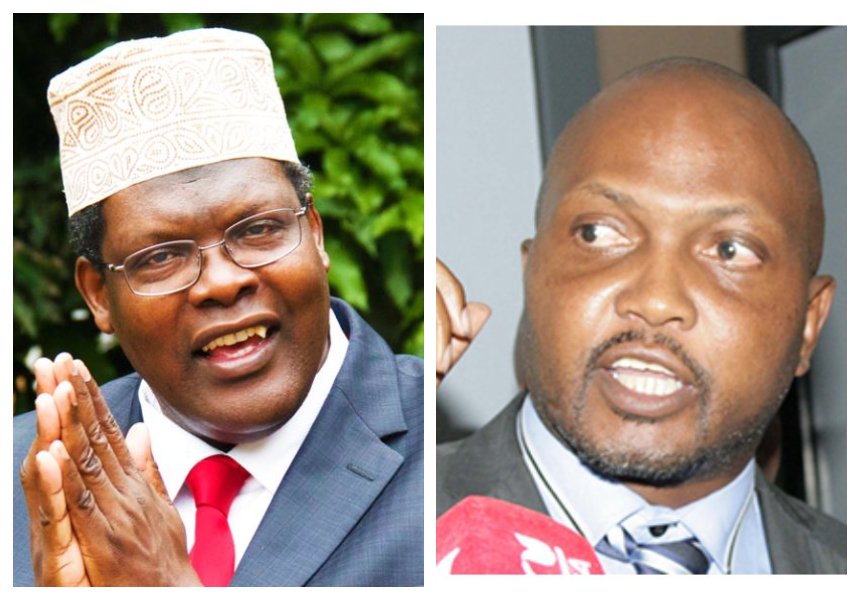

Moses Kuria, the government’s senior economic advisor, explained that the Kenya Revenue Authority (KRA) will use these digital payment platforms as virtual electronic tax registers (ETRs). The initiative is part of a larger effort to expand the tax base and capture revenue from informal businesses that typically avoid paying taxes.

CHECK OUT:

Despite 16 million Kenyans being employed in the informal sector, only Ksh12 billion in income tax is collected from them annually, compared to Ksh500 billion from 3 million formally employed citizens. Kuria highlighted this disparity, noting that the new system aims to address it. “By Christmas 2024, every bill will function as a virtual ETR, ensuring no business, regardless of size, can evade taxes,” he said.

The new system is expected to significantly increase tax revenue by targeting previously untaxed informal businesses. Kuria stressed that the ultimate goal is to ensure fair tax contributions from both formal and informal businesses.

This initiative marks a major shift in Kenya’s tax collection approach. ETRs were first introduced in 2005 to streamline VAT collection and combat tax evasion, but they have limitations, as they depend on manual data entry, allowing room for error. By incorporating mobile payment platforms, the government aims to automate tax data collection, minimize errors, and close tax loopholes. Currently, only 200,000 ETR devices are in use, compared to over 2 million digital payment touchpoints.

ALSO CHECK OUT:

Kuria also suggested that integrating the informal sector into the tax system could lead to a reduction in income taxes for formal sector workers. “Once informal businesses are fully taxed, we may be able to lower the burden on the 3 million formal employees currently carrying much of the tax load,” he noted.

With Kenya’s thriving digital economy, mobile payments have become a key aspect of daily life. As of August 2024, there were over 78 million registered mobile money accounts and around 400,000 active paybills and tills. This extensive digital network offers the government a strong tool to track transactions and recover lost revenue.

“There will be no place to hide,” Kuria concluded, emphasizing that Kenya’s digitized economy gives the government an advantage in expanding its tax base.