Co-op Bank Group is pleased to report a Profit Before Tax of Kshs. 24.7 Billion for the third quarter of 2023, representing an 8.6% growth compared to Kshs. 22.7 Billion recorded in the third quarter of 2022.

This represents a Profit after Tax of Kshs. 18.4 Billion compared to Kshs. 17.1 Billion reported in 2022.

The strong performance by the Bank is in line with the Group’s strategic focus on sustainable growth, resilience, and agility.

Sustainable Finance Award

Co-op Bank has been named Overall Winner at the Kenya Bankers Association (KBA) 2023 Sustainable Finance Catalyst Awards.

This is the fourth time in six years that Co-op Bank has been named overall winner, having also won the overall title in 2017, 2019 and last year 2022.

In addition to scooping the overall title, Co-op Bank also won in specific award categories that include being named as the Most Innovative Bank, Best in Financing Commercial Clients, Best in Promoting Gender Inclusivity, and the Best in Promoting Accessibility for People with Disabilities (PWD).

Key Q32023 Performance highlights:

Financial Position: The Group has registered sustained growth as follows;

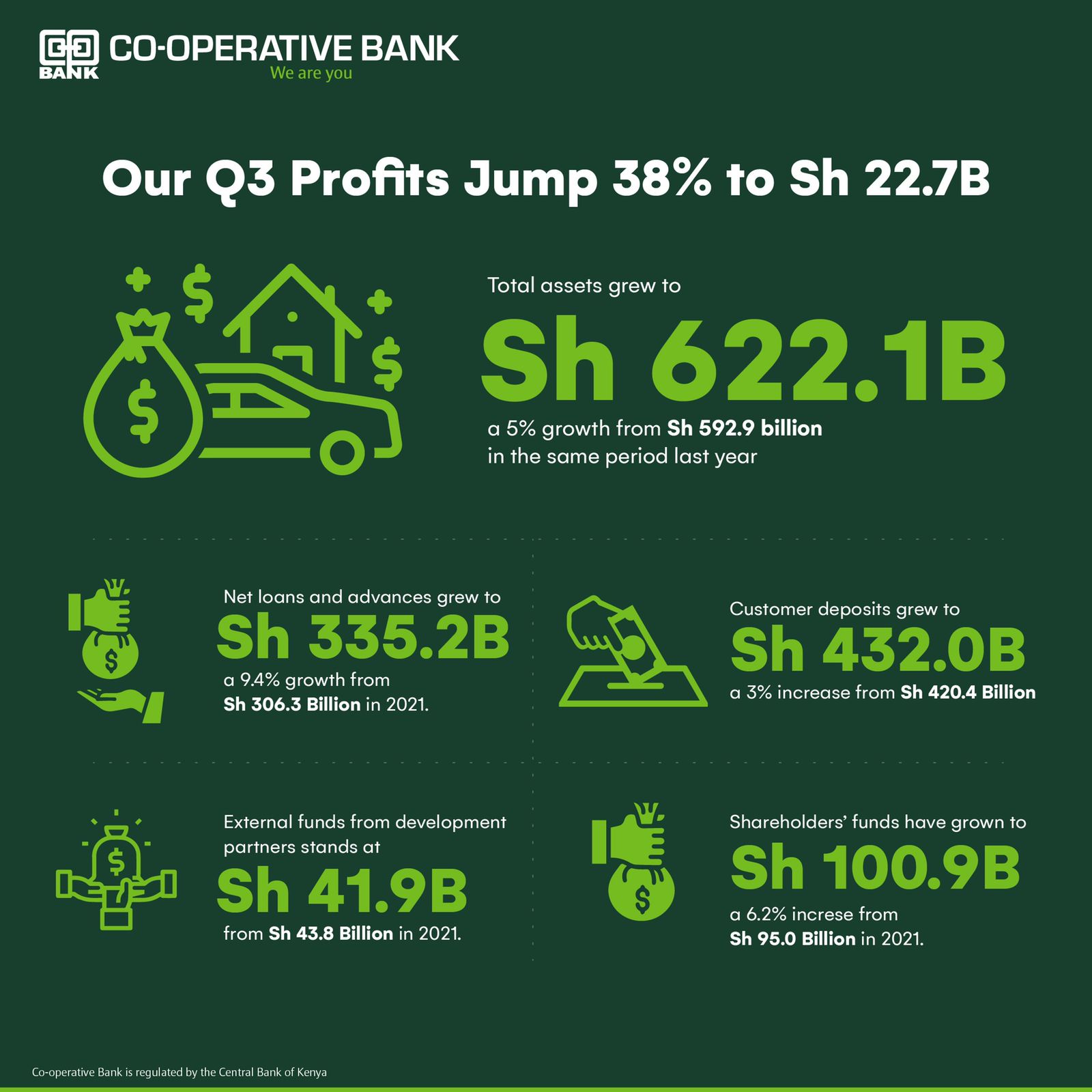

Total Assets grew to Kshs. 661.3 Billion, a 6.3% growth from Kshs 622.1 Billion in the same period last year.

Net loans and advances grew to Kshs. 378.1 Billion, a 12.8% growth from Kshs.335.2 Billion in 2022.

Customer deposits grew to Kshs 432.8 Billion, a 0.2% increase from Kshs. 432.0 Billion. External funds from development partners have increased by 56.5% to Kshs.65.6 Billion from Kshs. 41.9 Billion in 2022.

Shareholders’ funds have grown to Kshs. 108.1 Billion, a 7.1% increase from Kshs. 100.9 Billion in 2022.

Comprehensive Income

Total operating income grew by 2.3% from Kshs. 52.2 Billion to Kshs. 53.4 Billion.

Net interest income grew by 2.5% from Kshs 32.0 Billion to Kshs 32.8 Billion.

Total non-interest income grew by 2.1% from Kshs. 20.2 Billion to Kshs. 20.6 Billion.

Total operating expenses decreased by 2.1% from Kshs. 29.6 Billion to Kshs. 29.0 Billion.

Cost Management

The Group reports excellent efficiency gains from the various initiatives to record a Cost-to-Income Ratio of 46.4% in Q32023 from 59% in FY2014 when we began our Growth & Efficiency journey.

Credit Management remains a key focus area, with the Group prudentially making provisions of Kshs. 4.2 Billion which has supported the Bank’s Loan Loss Reserve/Coverage level of 69.1%.

A Strong Digital Footprint

The Bank successfully upgraded the core banking system to the latest version of Finacle from Infosys, which was rated globally as the top core banking system in 2022 by Gartner.

Through our digital channel strategy, the Bank has successfully moved 91% of all customer transactions to alternative delivery channels, a 24-hour contact centre, 608 ATMs & Cash Deposit Machines (CDMs), mobile & internet banking and over 18,000 network of Co-op kwa Jirani agents.

We have successfully migrated our customers to the Omni-channel, integrating accessibility and user experience that interfaces online banking through personal computers, mobile phones and USSD.

MCo-op Cash Mobile wallet continues to drive substantial non-funded income streams with 5 Million customers registered and Kshs 59.4 Billion in loans disbursed year to date, averaging Kshs. 6.6 Billion per month.

Over 193,000 customers have taken up the MSME packages we rolled out in 2018, and 42,413 have been trained on business management skills.

Year to date, we have disbursed Kshs. 15.9 Billion to MSMEs through our Mobile E-Credit solution. MSMEs make up 15.5% of our total Loan Book.

Our unique model of retail banking services avails access to cash for FOSA operations, enabling 484 FOSA outlets to support over 15 million Sacco members access banking services even in rural/remote areas.

Expanding Branch Network

The Bank has grown the branch network to 193 (4 in South Sudan). Eight (8) new Branches (Nakuru Bahati Road, Kimana, Matuu, Thika Kwame Nkrumah, Greenwood Mall – Meru, Kenol Makuyu, Hindi – Lamu and Bamburi – Mombasa) opened in 2023, whereas 5 Branches (Kabarnet, Iten, Kasarani, Kamakis and Chwele) opened last year.

Subsidiaries

Co-op Consultancy & Bancassurance Intermediary Ltd posted a Profit Before Tax of Kshs 762.9 Million in Q32023, riding on strong penetration of Bancassurance business.

Co-operative Bank of South Sudan that is a unique joint venture (JV) partnership with Government of South Sudan (Co-op Bank 51% and GOSS 49%) made a Profit before tax of Kshs 246.9 Million in Q32023.

Co-op Trust Investment Services Ltd contributed Kshs. 154.5 Million Profit Before Tax in Q32023, a 9.6% growth. The Subsidiary has Funds Under Management of Kshs. 196 Billion (Q32023).

Kingdom Bank Limited (A niche MSME Bank) has contributed a Profit before Tax of Kshs. 786.6 Million in Q32023, a remarkable growth of 24.8% from Kshs. 630.2 Million reported last year.

Environmental Social & Governance (ESG) Practice

The Bank continues to implement a best-in-class ESG policy framework supported by an ESG implementation roadmap, groupwide ESG champions and ESG Governance.

The Bank has invested in a unique forest rehabilitation project at “Solio Hill, Laikipia”; this is a partnership with the local community under the Community Forest Association and Kenya Forest Service (KFS) that has so far planted over 250,000 purely indigenous trees at the 600-acre government forest.

Co-op Bank Foundation, the Group’s social investment vehicle, continues to provide Scholarships to 10,264 gifted but needy students from all regions of Kenya.

Accolades

2023 Sustainable Finance Catalyst Award

Co-op Bank has emerged Overall Winner at this year’s Kenya Bankers Association (KBA) Sustainable Finance Catalyst Awards.

This is the fourth time in six years that Co-op Bank has been named overall winner, having also won the overall title in 2017, 2019 and last year 2022.

Commenting on the Award, the Group Managing Director & CEO, Dr. Gideon Muriuki said;

“Sustainability is fully integrated in our business model that stands on the three pillars of Economic Sustainability, Social Sustainability and Environmental Stewardship.”

“As a Bank that is predominantly-owned by the 15 million-member Co-operative Movement that is represented in all regions of the country, we are inclusive by design, which has enabled us to not only deliver shared prosperity today, but also helped us build an awareness and prudence to avoid participation in activities that risk putting future generations in jeopardy.”

2023 IFC Global SME Awards

Co-op Bank was awarded the SME Financier of the year in Africa – Gold Award at the Global SME Finance Awards 2023.

The Awards recognize financial institutions and fintech companies for their outstanding achievements in delivering exceptional products and services to their SME clients.

TAB Global – The Middle East and Africa Awards 2023

Co-op Bank and Intellect Global Consumer Banking were awarded Best Omnichannel Technology Implementation by TAB Global (The Middle East and Africa Awards 2023).

The Awards recognize leadership in retail financial services, technology, risk and transaction finance in the Middle East and Africa.

Conclusion

The Group continues to pursue strategic initiatives that focus on resilience and growth in the various economic sectors.

This is anchored on a successful universal banking model supported by an innovative digital presence, a wide physical footprint, and the unique synergies in the over 15-million-member co-operative movement that is the largest in Africa.