Navigating the Contentious Terrain of Taxation on Digital Creators in Kenya

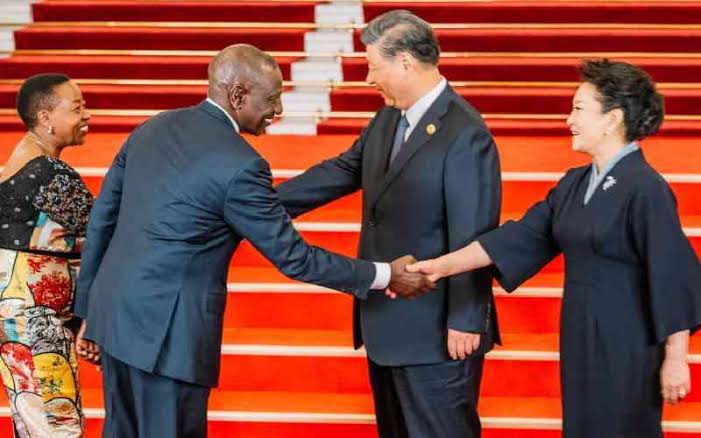

In a move that has sent ripples through Kenya’s burgeoning digital content creation community, President William Ruto has recently proposed taxing content creators who benefit from monetization schemes on platforms like TikTok, YouTube, and Meta. While the intention might be to broaden the tax base and ensure equity in taxation, this proposal opens up a Pandora’s box of debate, touching on issues of fairness, economic growth, and the support system for digital innovation.

A Tax on Creativity or a Step Towards Equity?

President Ruto’s argument hinges on the principle of equity: if traditional income earners are taxed, why should those earning through digital means be exempt? His remarks at the Kenya Private Sector Alliance’s 20th Anniversary suggested that with the ability to earn up to KSh 1 million from these platforms, it’s only fair that content creators contribute to the national tax kitty. However, this perspective brushes over the nuances of the digital economy. Content creators often invest significantly in their craft — in equipment, time, and learning — before they see any returns, which are not always guaranteed.

The Double-Edged Sword of Taxation

Introducing a tax on content creators could have a dual impact. On one hand, it might legitimize the digital economy, encouraging creators to formally register their income sources, potentially leading to a more structured and recognized industry. On the other hand, this could stifle creativity at a grassroots level. Young creators, who are just starting out or those from economically disadvantaged backgrounds, might find the additional financial burden daunting, potentially deterring them from pursuing content creation as a viable career path.

The Growth of the Digital Economy

Kenya has been at the forefront of digital innovation in Africa, with content creators playing a pivotal role in this narrative. They not only entertain but also educate, inform, and connect communities. Taxing this sector could inadvertently slow down this growth at a time when countries are racing to develop their digital economies. Instead of taxing, there could be incentives for creators to grow their reach and impact, which in turn could lead to higher tax revenues through increased economic activity.

A Case for Support Over Taxation

Rather than imposing taxes, the government could explore supporting this sector through grants, training, and infrastructure. This would not only boost the creative industry but also ensure that Kenya remains competitive in the global digital landscape. Additionally, there’s a need for clarity on how these taxes would be collected, considering the complexities of international digital platforms and the potential for double taxation if not carefully managed.

Listening to the Creators

The reaction from the content creation community has been mixed, with some feeling this is an attack on their nascent industry, while others acknowledge the need for all to contribute to national development. However, the key here is dialogue. The government should engage with creators to understand their challenges and contributions to the economy. This could lead to a more tailored approach to taxation, perhaps with thresholds or exemptions for those earning below a certain amount, recognizing the investment and risk involved in content creation.