High school days were totally miserable but we learnt critical lessons on financial management

Image: Moi Kabarak High School students singing in celebration on February 28, 2011 after the best last year KCSE student Alber Wandui Kamau came from their school. The students went around the school singing and dancing for joy. JOSEPH KIHERI[NAKURU]Life in high school was, at best, a miserable time.

It’s a wonder, and one of life’s greatest mysteries why everyone misses it.

Is it the food, whose broth was indefinitely afloat with black weevils? That daily bread would be eternally damned as food not even fit for death row prisoners, but, still……

The administration would go one rung lower on the ladder of humanity by garnishing the weevil-infested meals with a dash of kerosene.

Is it the crazy hours for the morning preps?

In high school, there was none of that patronizing line: “Hey, am kind of a morning person, you know…”

The penalty for missing the 4.30 AM call (and, getting caught), was hauling bedding to the central parade square, and spending the day tucked in. Forget the hot overhead sun for a moment, the load of judgmental stares from schoolmates would be unnerving, and haunt you for weeks.

Not all gloom, though.

High school had two categories of people: the grumps, and, the life enthusiasts.

If you loved high school, and didn’t kind of wish the intermittent teacher’s strikes to go on forever – you were the former. A grump.

The others would be life enthusiasts.

Different things helped people get through this phase.

For once, high school was flush with books to read. Yes, pun intended. Fun books to read, not the complex, tiresome arithmetic books. Novels.

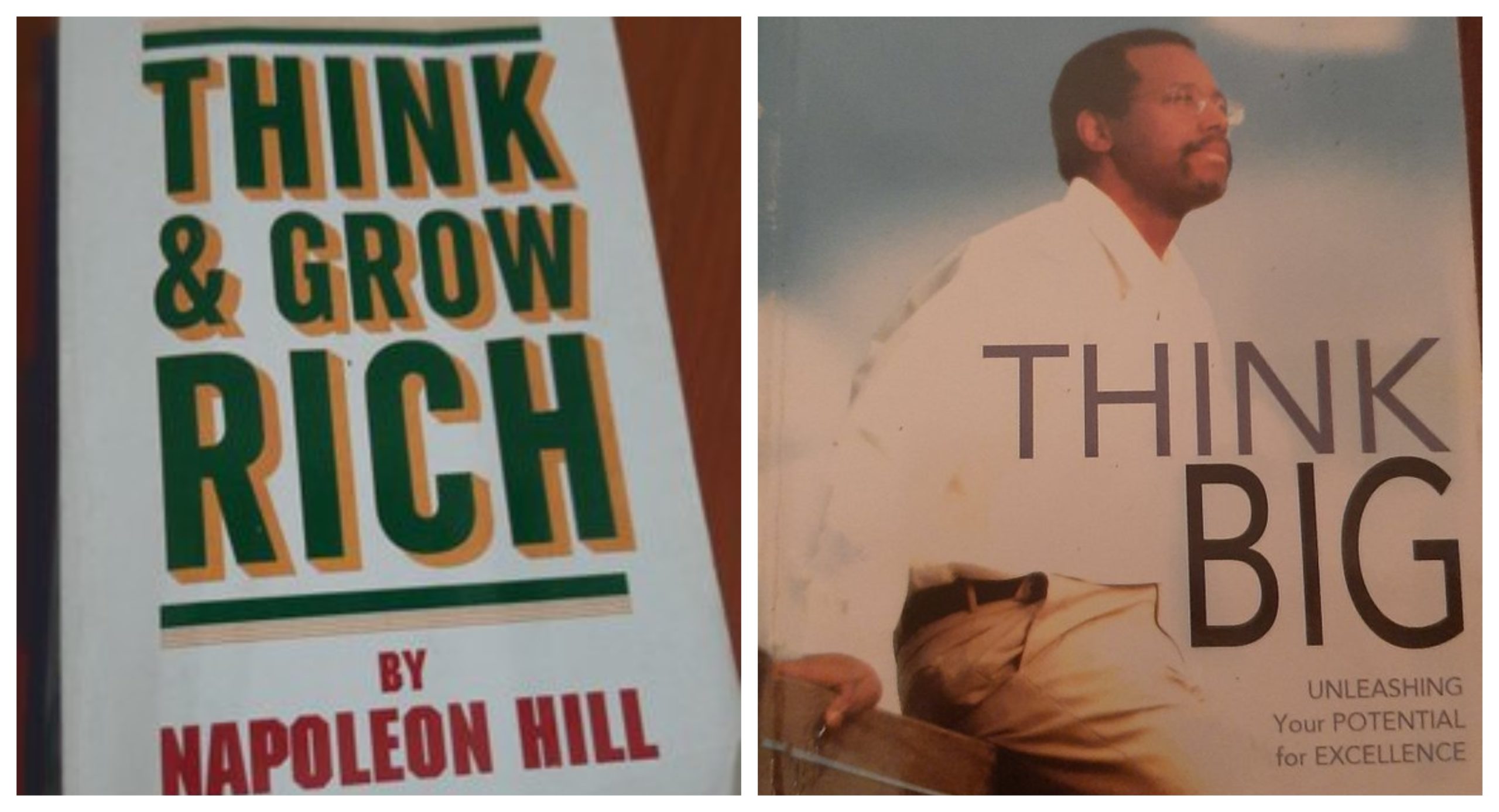

The favorite books were the inspirational kind.

Books like Think Big, by Ben Carson. An incredible brain surgeon’s story of humble beginnings in a single-parent household fraught with challenges to conquer the world of medicine. That book would leave your head throbbing. For a week or so, you’d be so high and psyched on inspiration that you’d actually attempt Physics assignments.

The second week, you’d be back to copy pasting Mark’s assignments.

Mark was a celebrated, self-confessed Grump. School heads of departments would almost get into physical fights to have him as a prefect or captain in their departments.

Another book that ranked closely was Rich Dad, Poor Dad, an emasculate rendition of bad and super-bad parenting by Robert Kiyosaki, and Sharon Lechter. On paper, it advocates the importance of financial literacy, and education.

In reality, the book Rich Dad, Poor Dad would be an orthodox scale we’d use to gauge our parents – and they’d always be found wanting. They’d hopelessly fall short of the ideal and accepted levels of parenting.

Not once, did I see a high school kid content, as appertains to parenting levels. The levels were inadvertently raised by these inspirational books!

There’s no proof yet, but this generation has spawned the modern inspirational speakers, and entrepreneurs.

A motivational speaker cum entrepreneur up on stage, in a sharp, rented Italian suit will go:

“I own a multi-million dairy business with hundreds of dairy cows and employs thousands of workers on a daily basis. I started all this – pause for effect – with a pair of gumboots….”

Well, as a parent now, take it as a task to teach your kids the mathematics of money.

If so inclined, every kid should learn financial accounting, and perfect it. Then, savings discipline. Luckily, there are structures and banking partners helping you to start as early as possible.

The Jumbo Junior Bank Account, with Co-op Bank.

Co-op Bank has a transitional account that’s a perfect tool to teach the saving culture to kids, and financial discipline that will be beneficial in their adulthood. It’s designed for children below the age of 18 years, for the safe keeping of money.

Besides, there’s a load of unbelievable benefits, like, automatic membership to the elite Jumbo Junior Club.

To sign up, or learn more about Jumbo Junior, visit the nearest Co-op Bank branch, or click here.

The Big Bank Account….For Little People!