Government States That The Price Of Bread Will Increase To Help Reduce Diabetes

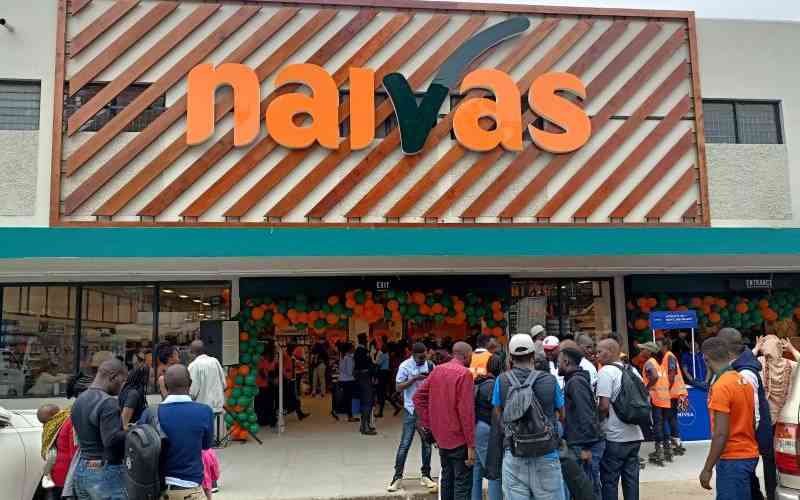

The Kenyan government’s plan to include a 16% Value Added Tax (VAT) on bread in the Finance Bill 2024 has faced strong criticism from the public. While the National Treasury claims the tax is a health measure to address rising diabetes, many Kenyans question its logic and potential negative impacts.

Public outcry and lack of evidence

Molo MP Kuria Kimani, Chair of the National Assembly’s Finance Committee, acknowledged the public’s concerns. Kenyans argue that bread is a staple food, not a luxury, and taxing it would create a burden on their daily lives. Additionally, Kimani revealed the National Treasury offered no specific study linking bread consumption to diabetes, raising doubts about the tax’s justification.

Read also;

Kate Actress Refutes Claims Of Leaving Husband After Getting Rich

Importance of Public Participation

Kimani emphasized the importance of public feedback on the Finance Bill. The committee will weigh the Treasury’s proposal against public opinion before making a final decision. A key concern is that taxing supermarket bread could push people towards untaxed bread from small bakeries and vendors, potentially leading to even greater health risks.

Three Possible Outcomes

Currently, bread is exempt from VAT. After public consultations, the committee proposes three possible scenarios:

- The 16% VAT remains on bread.

- Bread becomes completely tax-exempt.

- Bread returns to its zero-rated status (no VAT applicable).

Read also;

Kate Actress Refutes Claims Of Leaving Husband After Getting Rich

Kimani assured the public that all feedback will be carefully considered when drafting the committee’s final report