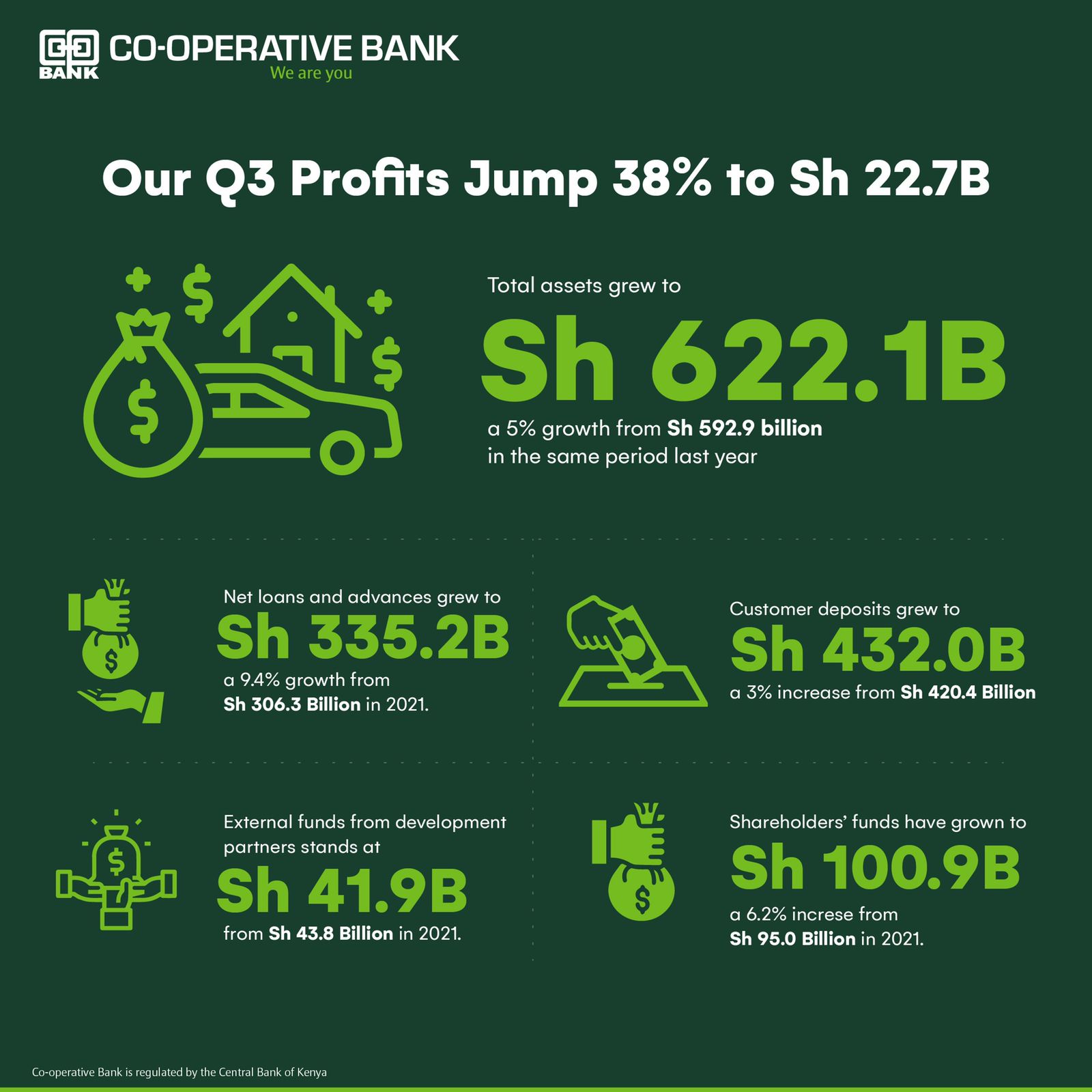

Co-op Bank marks 38% Profit Growth with Ksh22.7 Billion Profits Before Tax in 3rd Quarter

Co-op Bank Group is pleased to report a Profit Before Tax of Kshs. 22.7 Billion for the third quarter of 2022.

That’s a commendable 38% growth compared to Kshs. 16.5 Billion recorded in the third quarter of 2021.

This means, Co-op Bank has a strong Profit after Tax of Kshs. 17.1 Billion compared to Kshs. 11.6 Billion reported in 2021. The performance delivers a competitive Return on Equity of 23% to our shareholders.

The strong performance by the Bank is in line with the Group’s strategic focus on sustainable growth, resilience, and agility.

Support to the Fundraising Appeal to Fight Hunger

Co-op Bank Group wishes to join other Kenyans and indeed the global community of goodwill in fully supporting the Fundraising Appeal initiated by His Excellency the President, with a key contribution of Kshs.150 Million.

This is in support of relief efforts aimed at assisting families affected by the severe drought ravaging various parts of the Country.

Key Performance highlights;

1. Financial Position:

The Group has registered sustained growth as follows;

- Total Assets grew to Kshs. 622.1 Billion, a 5% growth from Kshs 592.9 Billion in the same period last year.

- Net loans and advances grew to Kshs. 335.2 Billion, a 9.4% growth from Kshs.306.3 Billion in 2021.

- Customer deposits grew to Kshs 432.0 Billion, a 3% increase from Kshs.420.4 Billion.

- External funds from development partners stands at Kshs 41.9 Billion from Kshs.43.8 Billion in 2021.

- Shareholders’ funds have grown to Kshs. 100.9 Billion, a 6.2% increase from Kshs. 95.0 Billion in 2021.

2. Comprehensive Income

This is a 3-pronged approach:

- Total operating income grew by 17.6% from Kshs 44.4 Billion to Kshs 52.2 Billion.

Total non-interest income grew by 28.3% from Kshs 15.7 Billion to Kshs 20.2 Billion. - Net interest income grew by 11.7% from Kshs 28.7 Billion to Kshs 32.00 Billion.

- Total operating expenses increased by 6% from Kshs 28.0 Billion to Kshs. 29.6 Billion.

3. Cost Management

Excellent gains from our various initiatives with a Cost to Income ratio of 45.8% in Q32022 from 59% in FY2014 when we began our Growth & Efficiency journey.

4. Credit Management

This remains a key focus area that has achieved key milestones. The Group prudentially provided Kshs. 5.7 Billion compared to Kshs 6.0 billion provided in 2021, pointing to an improvement in the quality of the asset book.

5. A Strong Digital Footprint

Through our digital channel strategy, the Bank has successfully moved 94% of all customer transactions to alternative delivery channels, a 24-hour contact centre, mobile banking, 550 ATMs, internet banking and a wide network of Co-op kwa Jirani agents.

We have successfully migrated our customers to the Omni-channel, integrating accessibility and user experience.

Our omnichannel interfaces online banking through personal computers, mobile phones and USSD availing our services to all customers through their preferred channel yet retain the same experience from wherever they are.

6. Subsidiaries

A great part of the success story arises from subsidiaries across the region:

- Co-op Consultancy & Bancassurance Intermediary Ltd posted a Profit Before Tax of Kshs 772 Million in Q32022, riding on strong penetration of Bancassurance business.

- Co-operative Bank of South Sudan that is a unique joint venture (JV) partnership with Government of South Sudan (Co-op Bank 51% and GOSS 49%) returned a profit of Kshs 190 Million in Q32022 compared to a loss of Kshs.104 million in Q32021.

- Co-op Trust Investment Services contributed Kshs. 141 Million in Profit Before Tax in Q32022, with Funds Under Management of Kshs. 202.6 Billion compared to Kshs.187.1 Billion in September 2021.

- Kingdom Bank Limited (A Niche MSME Bank) has contributed a Profit before Tax of Kshs.609.2 Million in Q32022 compared to Kshs. 413.1 Million reported last year representing a 47% Growth year-on-year.

Environmental Social and Governance (ESG).

The Group was named Overall Winner at the Kenya Bankers Association Catalyst Awards held in September 2022.

The awards recognize organizations that exemplify their sustainability prowess though promoting catalytic finance that impacts industry, economy and society.

This latest win is the third in five years, having won in 2017 and 2019, ranking Co-op Bank as Industry Leader in Sustainable Finance in Kenya.

Co-op Bank Foundation, the Group’s social investment vehicle, continues to provide Scholarships to gifted but needy students from all regions of Kenya. The sponsorship includes fully paid secondary education, full fees for University education, Internships and career openings for beneficiaries.

The foundation is fully funded by the bank and has supported 9553 students since the inception of the program.

7. Accolades

The Group Managing Director & CEO Dr. Gideon Muriuki was honoured with the award of a third Doctorate degree by the Africa International University in November 2022.

The Citation for the degree award noted his illustrious career in banking, his historic turnaround of Co-op Bank, his destiny-defining contribution to the co-operative movement and an enduring commitment to sustainable finance in Africa.